MAIN COVER →

Foreword & Preface

1

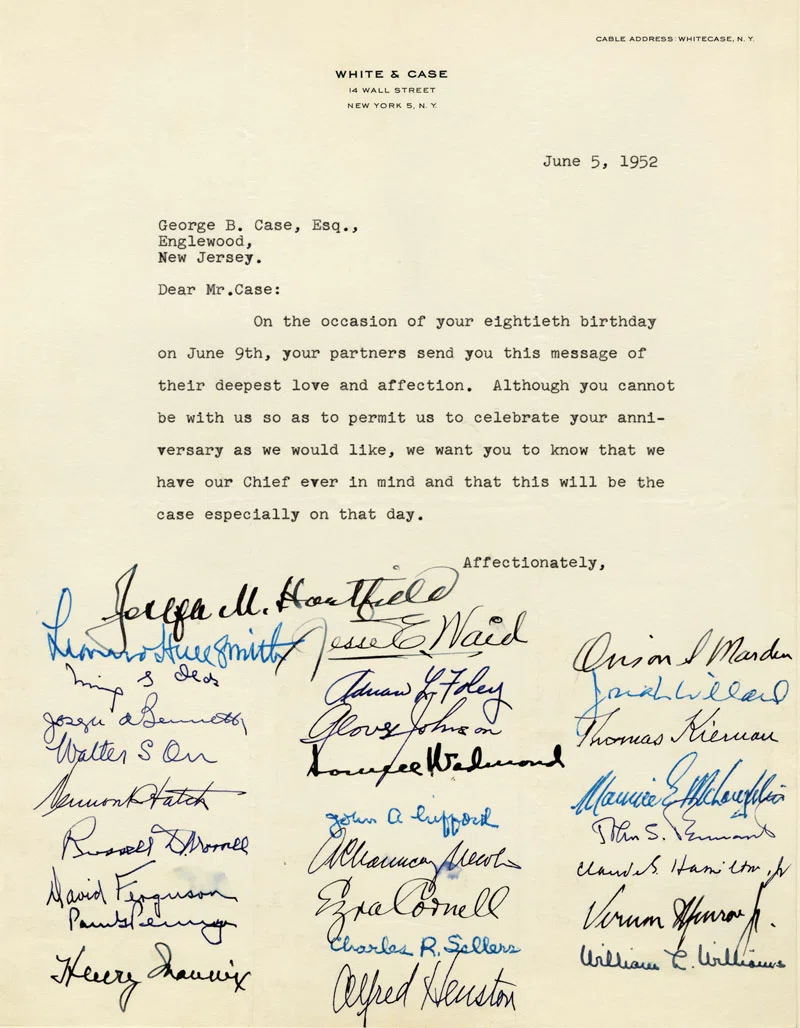

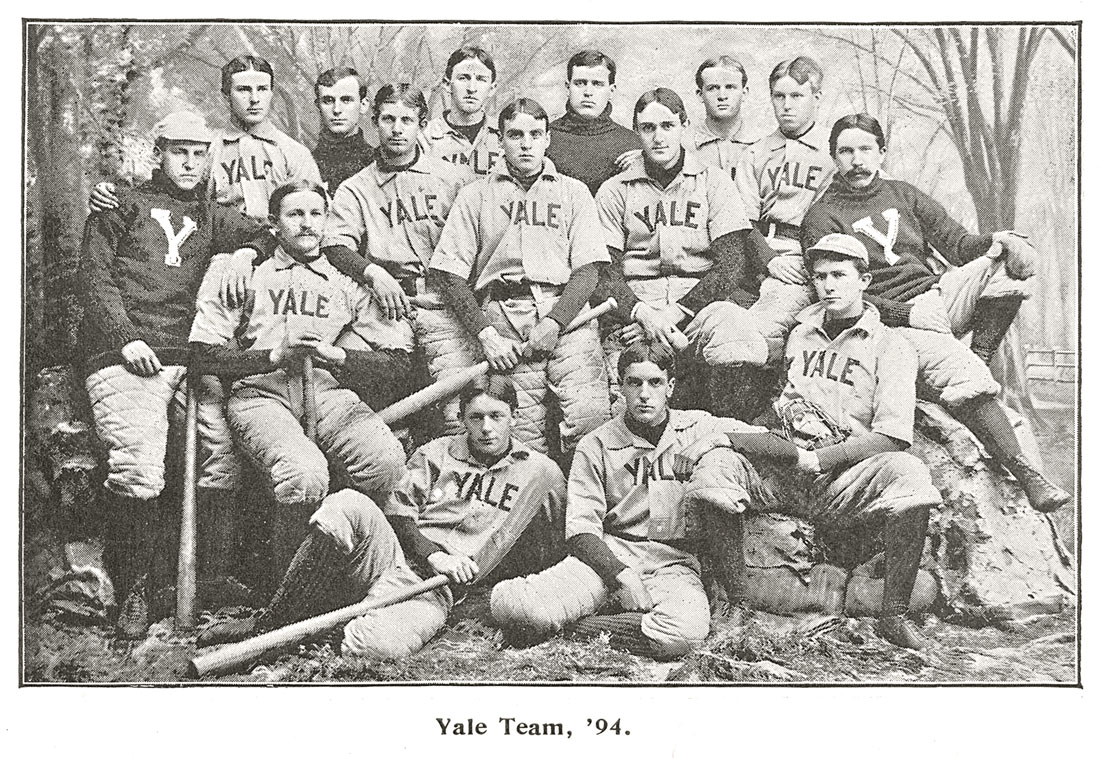

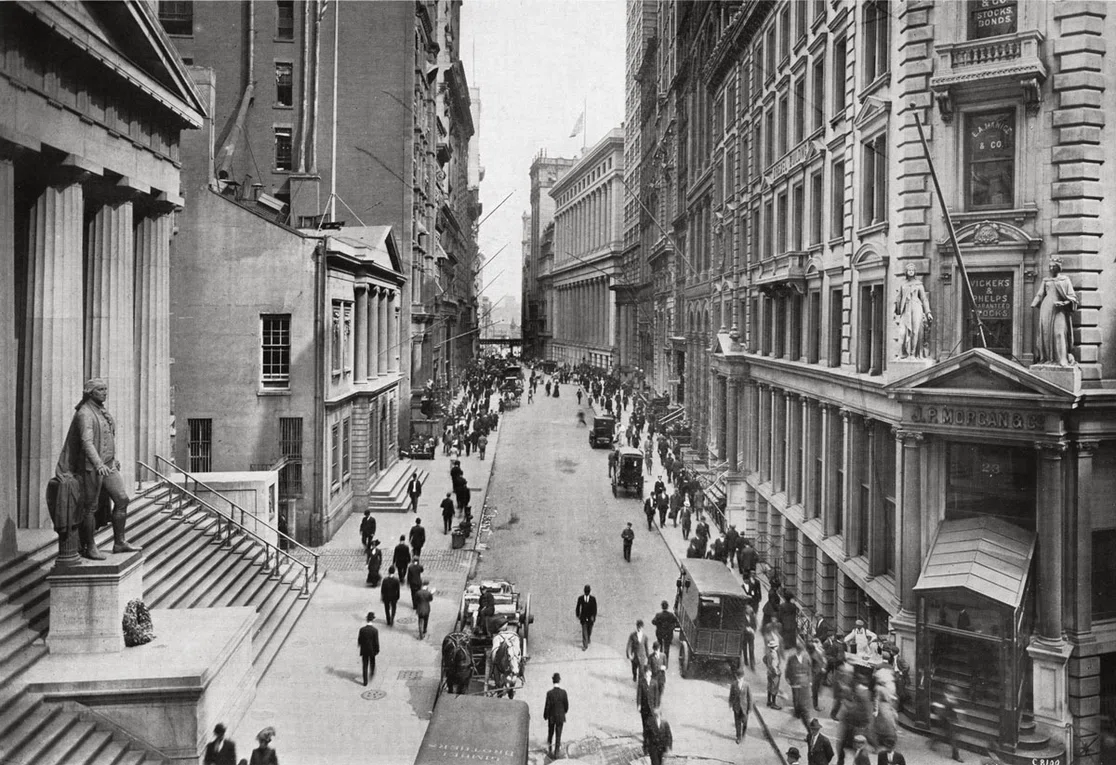

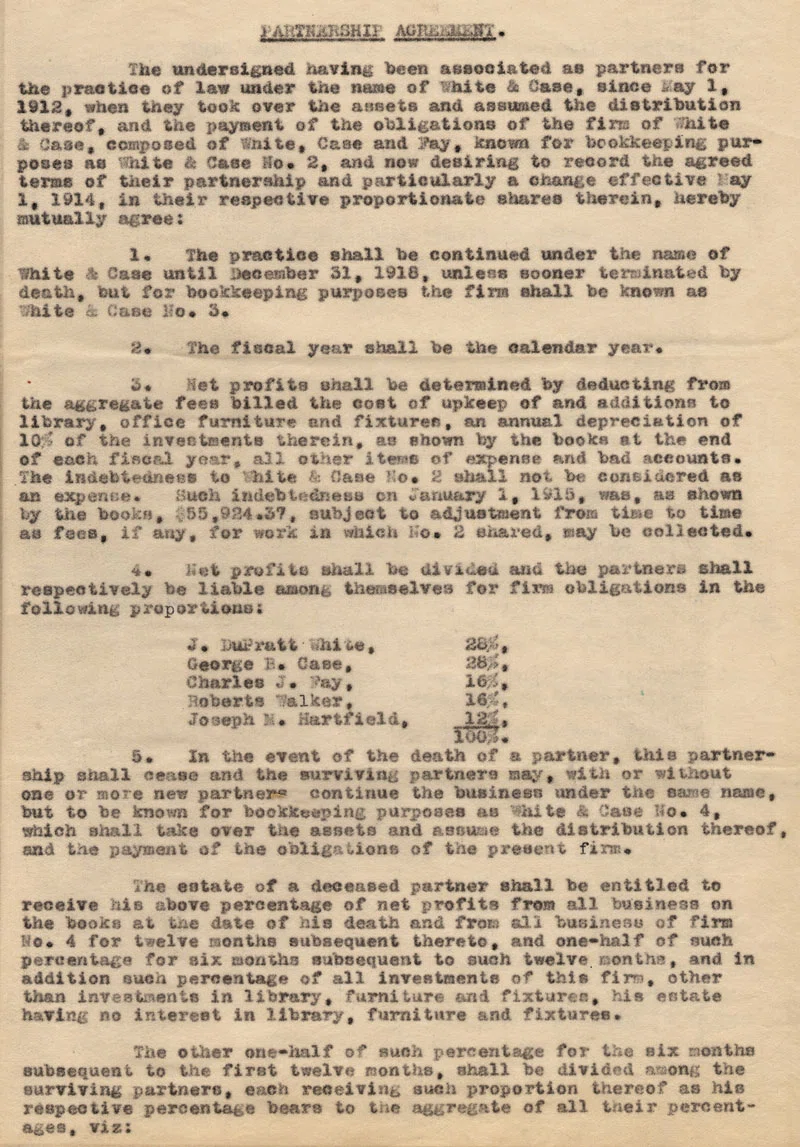

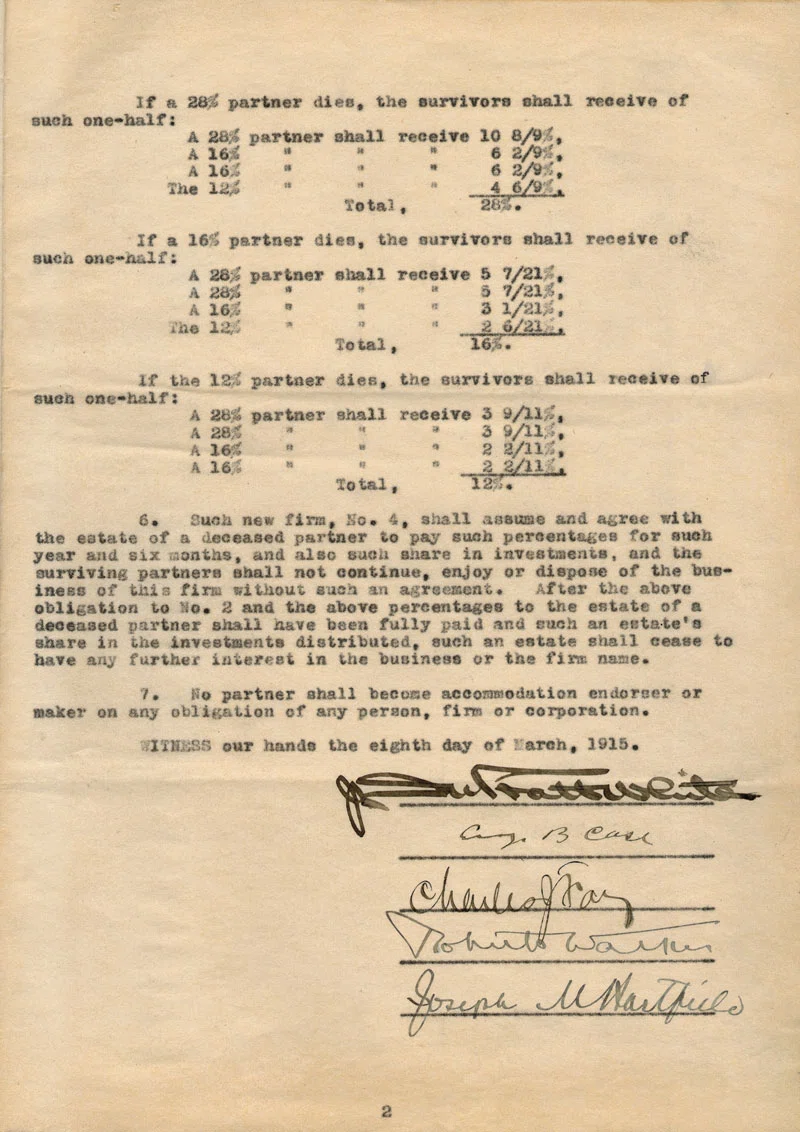

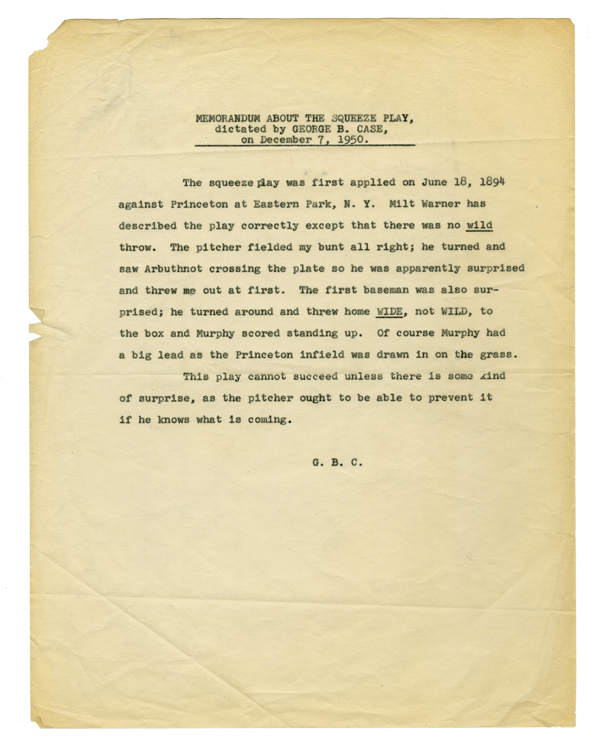

Foundation

2

Financial Institutions

TIMELINE: WHITE

&

CASE IN HISTORY →IMAGE LIBRARY →

PART I: THE FIRST 75 YEARS →

Contents

3

Corporate Clients

4

In the Courtroom

5

New Horizons

6

Sovereign Practice

PART II: THE NEXT 25 YEARS AND BEYOND →

7

Transition

8

Going Global

9

Globalization of Practices

PART III: KEEPING FAITH WITH THE FOUNDERS →

10

Culture

11

Social Responsibility

PART IV: ONWARD INTO THE 21ST CENTURY →

12

The Global Journey Continues

Afterword

HISTORICAL REFERENCES AND ARCHIVES →

White & Case Partners: May 1, 1901 - July 1, 2016

Offices

Former Offices

Headcount & Revenues

Global Partner Meetings

Senior Leadership Chronology

Historical Archives

Acknowledgments

Project finance

Antitrust

Asset finance

Banking

Capital markets

International arbitration

Commercial litigation

Financial restructuring and insolvency

Intellectual property

International trade

Mergers and acquisitions

Tax

White collar

Environmental

Private clients

Real estate

Profile: Mort Moskin

Profile: Walter Orr

Profile: Sims Farr

The Hurlock vision was to create an international network of offices around the world, forge global practices and build a client base that reflected this geographic expansion. The development of the sovereign practice triggered opportunities for the creation of new practices, as well as for growing existing ones, resulting in new clients and advancement of the strategic objective of globalization. The process began in the final quarter of the 20th century and continued up to and beyond the celebration of the Firm’s centennial in 2001.

The two practices that benefited most directly from the sovereign work were project finance and international arbitration, but other practices, too, developed in new, international directions as the geographic reach of the Firm expanded.

These include practices that the Firm has designated as global practice groups—antitrust, asset finance, banking, capital markets, commercial litigation, financial restructuring and insolvency (FRI), intellectual property, international trade, mergers and acquisitions (M&A), tax and white collar. This chapter summarizes the evolution of these and other practices and highlights key developments and major transactions or cases in each of them.

“We were operating in new territory, both geographically and legally. We were creating the documentation for inordinately complex structures that had to stand up to scrutiny over the long duration of these projects. It was truly pioneering work.”

Gene Goodwillie

VIEW IN GALLERY

Saudi Aramco’s complex at Ras Tanura, one of the world’s largest crude oil terminals

During the Firm’s more than 50-year relationship with Saudi Aramco, its project finance team has assisted the company with major projects for the development of these and other facilities in Saudi Arabia and throughout the world.

Project finance was not a new concept in the 1970s, but it became more prominent during that decade as banks and other institutions began to provide funds to develop oil and gas production in the North Sea. Banks in London became particularly interested in participating in North Sea project finance activity.

Gene Goodwillie, who moved to London in 1975 to head the Firm’s office there, spotted an opportunity for the Firm to develop this practice area in an international context. The first project, subsequently aborted with the fall of the Shah of Iran, was a major undertaking to develop natural gas reserves in the North Field between Iran and Qatar and convert that gas into liquefied natural gas (LNG) for export to consumers in the Asia-Pacific region. The Firm acted for the project financial adviser Bankers Trust International (BTI) and the project sponsors, one of which was Chicago Bridge & Iron Company, which would subsequently use White & Case for other projects it developed around the world. One such other project, on which Goodwillie also advised, was Statia Terminals Group’s oil storage and transshipment terminal on St. Eustatius Island in the Netherlands Antilles.

BTI was a regular client of the Firm and also introduced Goodwillie to the Australian entrepreneur Robert Strauss. Strauss had invested in a bankrupt company in reorganization, Bridge Oil, which after its reorganization discovered a major oil field in the Cooper Basin in Australia. Strauss had international ambitions and later invested through Bridge Oil in a diamond mine in Guinea, West Africa. The London and Paris offices of the Firm were retained to represent the lenders, including Bankers Trust, on the Aredor Guinea diamond mine project. It was a project fraught with problems, but it did yield two of the largest gem-quality diamonds in the world and repaid all the project debt, as well as Strauss’s equity investment. There was another quirk, too: Strauss was so impressed with the quality of counsel White & Case offered to its clients that he requested it swap sides and become his counsel. As their loans had been repaid, the lenders agreed. In the write-up of the deal,

Australian Business

commented that Goodwillie was one of the four key personalities who helped make the transaction a success.

“We were operating in new territory, both geographically and legally,” recalls Goodwillie. “We were creating the documentation for inordinately complex structures that had to stand up to scrutiny over the long duration of these projects—which they did. It was truly pioneering work.” Others involved in the Guinea project were Jean-Luc Boussard and Rosine Lorotte, who on each visit would take down a suitcase of books to Guinea to give to the local Catholic Church.

The Statia project, originally only worth some $75 million, underwent changes of ownership and a number of financial restructurings, which kept Goodwillie and his team occupied for a good 10 years. One of the principal terminal storage customers of the Statia project, by coincidence, was Saudi Aramco, which had become a client of the Firm when the Firm represented Aramco in the 1950s in connection with antitrust allegations and an arbitration involving Aristotle Onassis. Aramco had been established in the early 1930s by Standard Oil of California (Chevron) to explore, develop and produce Saudi Arabia’s oil reserves. As became apparent, this was the most valuable concession ever granted. Texaco joined Chevron as an investor in Aramco before World War II, and the two of them were joined after the war by Standard Oil of New Jersey (Exxon) and Mobil. As the 1950s began, those four U.S. companies were Aramco’s owners. During the oil booms of the 1970s, the Saudi government began negotiating with the four Aramco owners to acquire a 60 percent, and eventually 100 percent, participation interest in Aramco. The negotiations proceeded over a number of years, and eventually all of Aramco’s assets, including its rights under the oil concession, were transferred to Saudi Arabian Oil Company (Saudi Aramco), which was established in 1988 and is wholly owned by the government. The Firm assisted with the asset transfer, meaning that it has represented Saudi Aramco since its very inception.

The Firm’s groundbreaking debt restructuring work for the Indonesian government also provided a platform for project work in Indonesia and then further afield in Asia and Europe. The Firm’s Jakarta team, led at various times by Hank Amon, George Crozer, Maddrey, Philip Stopford and Ray Vickers, was retained to advise on the financing of LNG plants at Arun and Bontang as well as on refinery expansions for the state oil company, Pertamina, at Balikpapan and Cilacap. Crozer and others created an innovative trustee borrowing structure that served as an alternative to customary security interests in favor of lending banks and came to be used extensively in Indonesia for LNG, petrochemical and refinery projects.

The experience of advising on LNG projects in Indonesia served the Firm elsewhere, including when it pitched for and won a prized mandate to advise on a series of gas projects in Qatar from the mid-1990s onward. Stopford, who had been in Jakarta and Frankfurt before moving to London in 1993, led the team that advised the upstream lenders on Qatargas 1, and then on follow-up projects. He had been recommended to the lenders by John Riggs in the Paris office. “Qatargas 1 was a real breakthrough for us,” Stopford recalls. “We were pitching against one of the magic circle firms, but won the mandate. We then proved ourselves as a firm that was capable of handling the documents associated with a horrendously complicated deal that involved five different owners and 37 different loan tranches. It also marked an important turning point in the development of the London office.”

Bontang lng plant f train construction

View in gallery

Beginning in 1978, the firm represented pertamina in a series of projects to develop and expand the capacity of the bontang plant, including the $750 million f train financing in 1991.

Building on the relationships first developed by Lowell Wadmond and maintained and expanded by Jeff O’Sullivan, Goodwillie, Wendell Maddrey and many other partners, the Firm was well positioned to work closely with Saudi Aramco as the company invested domestically and internationally and diversified from producing crude oil into a fully integrated global energy company. White & Case has advised Saudi Aramco on virtually all of its major projects, disputes and other legal matters since 1988. Reflecting the substantial growth in the scale and scope of its operations, a 2012 article in

The Economist

reported that Saudi Aramco “controls more than a tenth of the world’s oil and with it the fate of the world economy.”

On the projects side, a team initially led by Goodwillie, and later by Maddrey, advised Saudi Aramco on its downstream investment program, including a joint venture with Texaco involving all of Texaco’s refining and marketing assets in 26 states in the United States; joint ventures in the Philippines, Korea and Japan; and in 1998 one of the most innovative downstream oil products business combinations in the history of the industry—the formation of a $16 billion tripartite joint venture between Saudi Aramco, Texaco and Shell to operate four U.S. refineries and to do joint marketing. Other notable projects included multibillion-dollar world-scale oil refineries and petrochemical facilities in Saudi Arabia and China during the first decade of the 21st century. Maddrey notes: “The shared values and experiences of the two institutions have made for an enduring relationship. Saudi Aramco’s geographic and operational growth both mirrored our own globalization and contributed significantly to the reputation of our project finance and other practice areas.”

“Qatargas 1 was a real breakthrough for us. We proved ourselves as a firm that was capable of handling the documents associated with a horrendously complicated deal that involved five different owners and 37 different loan tranches.”

Philip Stopford

Project finance

VIEW IN GALLERY

Sample roadmap prepared by Hugh Verrier, 1996

The poster illustrates the multiple complex steps required to develop a build-operate-transfer power project in Turkey.

Qatargas 2, on which the Firm also advised—this time for the sponsors—was more complicated still, involving a $15 billion joint venture between Qatar Petroleum and ExxonMobil, a liquefaction plant in Qatar, a regasification plant in Milford Haven and a fleet of tankers used to transport the gas. The original intention had been to build one processing “train” to process eight million tons of gas a year, but such was the take-up among lenders that the project capacity was increased to build two “trains”—at very short notice. As Stopford recalls, “The commercial banks offered to provide financing of $3.5 billion, when just $1 billion had been solicited, so we changed the project from a one-train project to a two-train project in a two-week period.” Qatargas 3, a joint venture with ConocoPhilips and Mitsui & Co., and Qatargas 4, a joint venture with Royal Dutch Shell, soon followed, again projects on which White & Case took a leading role. In sum, White & Case played a significant part in helping Qatar achieve its national ambition of becoming the world’s largest LNG exporter.

Over the years, the Firm has continued to play a significant role in the development of the global LNG market. Among other notable examples is its representation of the export credit agencies, multilateral lenders and commercial bank lenders in connection with the $20 billion Sakhalin LNG project in Russia, which included the construction and installation of more than 1,000 kilometers of pipelines, three offshore platforms, onshore processing facilities, an oil export terminal and a two-train LNG liquefaction facility. The Firm started work on the Sakhalin project in 2003, which, when it reached financial close in 2008, was the world’s largest energy project and the largest foreign investment in Russia. Crozer led the White & Case team initially and was succeeded by Peter Finlay when Crozer transferred from Hong Kong to Washington, D.C.

The Sakhalin project was a massive undertaking that drew upon the Firm’s resources in a wide range of disciplines and geographic locations. More than 280 legal staff were involved over the course of the project. Sakhalin was a “frontier project for its time,” Finlay recalls. “It led the way for big-ticket project financing of mega oil and gas assets in very tough and remote emerging markets. As with any first-to-market deal, innovative and creative ways had to be found to address the many challenges of dealing with the development of a significant integrated oil and gas project in the remote wilderness of Sakhalin Island in the far east of Russia and ice-locked for six months of the year.”

In Turkey, the Ankara office, headed by Hugh Verrier, advised on Turkey’s first-ever successful build-operate-transfer (BOT) project, the Marmara-Ereglisi Power Project. The Firm advised one of the sponsors, Enron, and the project closed in 1996 after a five-year negotiation, which paved the way for other BOT projects in Turkey as well as other countries.

The Firm’s internationally based project finance practice, which was successful in its own right by the early 1990s, received an extra boost when it converged with the Firm’s U.S.-based project finance practice to generate even more domestic and international power projects. The jump-start came with the introduction of the U.S. “PURPA” legislation in the late 1970s, which was designed to create independent power generation companies that would generate electricity and sell it at formula pricing (so-called “avoided cost”) to U.S. utility companies.

For a number of years in the 1980s, the Firm had developed a lender-side project finance practice representing banks lending on a project basis to fund “qualifying facilities” under PURPA and later independent power producers (IPPs). The Firm’s first U.S. IPP deal was a financing in 1985 by Swiss Bank Corporation structured as a non-recourse loan for the construction of a coal-fired power plant in Pennsylvania. About seven years later, after the Firm had represented lenders in a number of power plant project financings, the U.S. economy began to slump and the demand for new power plants in the United States weakened. The newly formed U.S. IPPs began to look for new markets, including the “tiger economies” of Asia, which were badly in need of enhanced infrastructure, especially reliable sources of power. The internationalization of the IPP model played to the Firm’s strengths. The Firm had a large international footprint, which most of its U.S. project finance law firm competitors did not, and the Firm’s lawyers had contacts at most of the IPP developers as a result of deals worked on in the United States. These factors made White & Case a logical choice as counsel for the IPP developers or their lenders as the IPP developers began developing their international projects.

Over the course of four decades, White & Case built from scratch one of the leading project finance practices of any law firm.

Two breakthrough projects highlighted the strength of White & Case’s international power practice. The first, led predominantly by U.S. sponsors Mission Energy and General Electric, was the 1995 Paiton power project in Indonesia. A team of the Firm’s lawyers led by Art Scavone acted for U.S. Ex-Im Bank and OPIC, which together lent $900 million and were among the largest lenders to the project. This was the first major project where the Firm’s U.S. practice converged with its international practice to combine the strengths of both practices, that is, the connections the Firm had with the IPPs in the United States, the experience of the Firm’s U.S. project finance lawyers with the U.S. IPP model, and the experience of its international project finance lawyers with working in Indonesia and other emerging markets.

The second breakthrough project was the Dabhol project (both Dabhol I and Dabhol II) in India, handled by Goodwillie and Larry Gannon. Dabhol was the first major power plant in India, and it was financed on a project basis by a large group of local and international lenders, all represented by White & Case.

As the project finance practice grew larger in the late 1980s and 1990s, the Firm combined its U.S. and international project finance practices into a single international practice under the leadership of Goodwillie, the objective being to achieve the best coordination possible of all the Firm’s global resources. As the demand for infrastructure development continued to grow in both developed and emerging market countries, the Firm’s presence in countries around the globe put it in a unique position to capitalize on an expanding number of project finance opportunities. The Firm leveraged its banking strength and relationships with banks to add additional lenders to its client base, but also undertook a successful campaign to expand the practice to represent sponsors, developers, suppliers and other participants. The excellent relationships established with U.S. Ex-Im Bank, International Finance Corporation (IFC), Japan Bank for International Cooperation (JBIC), European Bank for Reconstruction and Development (EBRD) and other export credit agencies and multilateral lending institutions resulted in the Firm representing these institutions in their project investments in emerging market countries.

“We are one of only a very small handful of firms that can handle the largest, most sophisticated international project financings in the world and are on everyone’s shortlist for these types of transactions.”

Art Scavone

The growth of the Firm’s project finance practice was also aided by the strength of the Firm’s transactional construction and engineering practice. By 2016, the lawyers in this practice had acted for clients in more than 90 countries and in many industries, including upstream oil and gas, LNG, petrochemical, power generation (including renewable, nuclear and conventional power), metals and mining, process plants, transport infrastructure and water.

Over the course of four decades, White & Case built from scratch one of the leading project finance practices of any law firm. The practice came to be known internally as EIPAF (energy, infrastructure, project and asset finance) to reflect the fact that energy projects and aircraft and other asset-based financings have similar structural characteristics and have become important components of the project finance practice. “Project finance fits very well with our international operation,” Goodwillie notes. “Many of the projects were in developing countries, and we could offer our clients the coverage they required.”

“When I look at our international project finance practice today,” observes Scavone, head of the global practice, “I am reminded of something Duane Wall told me a long time ago when he was speaking about Sean Geary at the height of the LBO finance market. He said that to be really successful in our business you needed to be someone whose name was one of only two or three that always came up whenever there was a complex, bet-the-ranch type of deal, the kind that clients would only entrust to the very top people. After years of building our international project finance practice, I believe we have achieved that level of success. We are one of only a very small handful of firms that can handle the largest, most sophisticated international project financings in the world and are on everyone’s shortlist for these types of transactions. Evidence of this is our representation of the main sponsor in the project financing of the $20 billion Sadara petrochemical project in Saudi Arabia, which will be one of the largest integrated chemical facilities in the world, and our representation of the U.S. export credit agencies in the project financing of the Paiton power project in Indonesia, which has been widely recognized as the project financing that set the template in the mid-’90s for international multisourced project financings. These are two of the largest, most complex project financings ever undertaken.”

“Sakhalin was a frontier project. Innovative and creative ways had to be found to address the many challenges of dealing with the development of a significant integrated oil and gas project in the remote wilderness in the far east of Russia.”

Peter Finlay

International arbitration

The practice that, more than any other, owes its initial growth to the success of the Firm’s sovereign practice is the Firm’s international arbitration practice. The international arbitration world operates somewhat like a club to which it is difficult to gain entry. The Firm’s representation of sovereign clients helped it develop the credentials for admission. The breakthrough came with winning the mandate to defend Indonesia in

Amco Asia v. Republic of Indonesia

, only the second case to come before the International Centre for Settlement of Investment Disputes (ICSID). The White & Case team, first headed by Charlie Brower and then by Carolyn Lamm, successfully secured an annulment of a foreign investment license. Lamm observes, “This case is very often cited because it wrote the history of annulment in those early ICSID proceedings, and from that we developed a reputation in terms of international arbitration on cutting-edge issues in the entire ICSID system.” Since representing Indonesia in Amco

, the Firm’s representation of sovereigns in international arbitrations has expanded to include, among others, Bulgaria, Chile, Georgia, Hungary, Jordan, Peru, the Philippines, Romania, Thailand, Ukraine and Uzbekistan, with several repeat appointments.

Each year, some 50 or 60 cases are heard by ICSID. Remarkably, the Firm acted in more than a third of the early ICSID cases and continues to work on these cases on a regular basis. An increase over the years in the number of bilateral investment treaties to more than 3,000, each of which has a consent to dispute resolution, also led to a further surge of work. These cases often involve groundbreaking issues and complexity. In Abaclat & Others v. Argentine Republic

, the Firm represented tens of thousands of bondholders with claims in excess of $1.3 billion in the first mass claim in investment arbitration history. SGS v. Republic of Paraguay

was a landmark decision concerning the interpretation of “umbrella clauses,” which expanded the potential protection afforded to foreign investors under international law. Metal-Tech v. Republic of Uzbekistan

was the first investment treaty claim before ICSID to be dismissed on corruption grounds.

In addition to the investor/state cases, in the 1980s the Firm developed a reputation for international commercial arbitration (that is, between companies of differing nationalities). As the volume of work increased, the arbitration practice entered into a virtuous cycle in which success fed on itself, attracting notable arbitration lawyers to join the Firm, including Gillis Wetter in Sweden, who wrote one of the original treatises on international arbitration; Chris Seppälä in Paris, one of the leading specialists in the construction area; and Steve Bond, a past secretary-general of the International Chamber of Commerce (ICC) International Court of Arbitration. Wetter worked on the

Amco

arbitration at the suggestion of Jim Hurlock, who told Lamm, then a junior lawyer, “You need a little grey hair to win this.”

Brower had joined White & Case in 1961, became a partner in 1969 and left the Firm that year to serve as acting legal adviser for the U.S. Department of State. When he rejoined the Firm in 1974, he concentrated on international arbitration and played a key role in developing the Firm’s reputation in the area. Then, in the mid-1990s, with the Firm’s practice growing at an accelerating pace, Ray Hamilton was appointed as the first official head of the practice and undertook the task of coordinating the work of the Firm’s arbitration lawyers in Paris, Stockholm, London, New York, Washington, D.C. and Hong Kong in order to shape the practice into a truly international one, perhaps the first of its kind in the legal sector. The practice continued to attract top talent. In 1997, Paul Friedland, who had opposed White & Case in the Amco

arbitration, joined the Firm in New York and succeeded Hamilton as head of the practice in 2002. Two years later, Michael Polkinghorne, a leading figure in the field of oil and gas disputes, joined the Firm in Paris.

The Firm became a leader in construction arbitration under the leadership of Seppälä in Paris and with the later lateral hires of John Bellhouse and Phillip Capper in London. The huge construction cases done by the international arbitration team contributed materially to the reputation and success of the practice.

Meanwhile, the arbitration group’s expertise in concession cases (whether ICSID or other) continued to grow. In PIATCO v. The Republic of the Philippines

, an ICC tribunal in Singapore dismissed more than $565 million in claims against the Firm’s client, the Republic of the Philippines, in a long-running dispute arising out of the nullification of a concession contract relating to the construction and operation of International Passenger Terminal 3 at Manila’s International Airport. Subsequently, the White & Case team of Lamm, Abby Cohen Smutny, Andrea Menaker and Jonathan Hamilton obtained a judgment from the Singapore High Court rejecting PIATCO’s application to set aside the ICC Award that had dismissed PIATCO’s claims against the Philippines. The conclusion of proceedings in Singapore marked the successful culmination of more than eight years of representing the Philippines in this dispute.“Our international arbitration practice fits naturally into the Firm’s global strategy and has benefited from its global platform.”

Paul Friedland

Machu Picchu, the 15th-century Inca site in Peru

View in gallery

White & Case advised the peruvian government on its claim to have cultural artifacts in the possession of yale university returned to the country. the principal artifacts were returned in 2011 in time for the 100th anniversary of the scientific discovery of machu picchu.

In the arbitration practice, an individual lawyer’s reputation is especially important in generating new business, and the Firm has several arbitration lawyers with stellar profiles. Two former members of the Firm’s arbitration practice were secretaries-general of the ICC International Court of Arbitration: Steve Bond and Horacio Grigera Naón. Seppälä was the vice-president emeritus of the ICC Court. At the American Arbitration Association (AAA), Lamm and Friedland served on the executive committee and the board of directors, and Friedland was chair of the AAA’s law committee and chair of the committee on redrafting the rules of the International Centre for Dispute Resolution. Friedland is also a member of the Court of the Singapore International Arbitration Centre. Smutny is chair and Jonathan Hamilton is vice-chair of the executive committee of the Institute for Transnational Arbitration, and Smutny is also president of the North American Users’ Council of the London Court of International Arbitration, of which Friedland was a member from 2002 to 2006. Ank Santens is chair of the arbitration committee of the International Institute for Conflict Prevention and Resolution (CPR).

While litigation is usually conducted in the courts of the country having the most contacts with the dispute being litigated, arbitrations may be conducted wherever the parties agree. This has enabled lawyers in the Firm’s offices around the world to participate in arbitrations in countries other than their home country. It has also enabled arbitration practitioners such as Aloke Ray (London, then New York, then Singapore) and John Willems (New York, then Paris) to relocate from their home offices to offices in other countries, strengthening the Firm’s arbitration practice even further.

As the Firm’s international arbitration practice has continued to expand, the Firm has handled arbitrations involving many countries and industries. In Latin America, one of the cases the Firm handled had a unique historical aspect. During a high-level dispute between the Republic of Peru and Yale University relating to ancient cultural patrimony from Machu Picchu, Peru filed a claim in a U.S. federal court seeking the return of artifacts excavated almost a century ago. Not long thereafter, Peruvian President Alan García called for the return of the artifacts, triggering a national and international campaign. Support for a possible agreement emerged from across Peru and among Yale alumni, other governments including Egypt and Ecuador, and scholars, leading to negotiations involving former Mexican President Ernesto Zedillo, then a Yale professor. White & Case, through Jonathan Hamilton, advised Peru during the breakthrough negotiations that resulted in a settlement agreement in November 2010, as a result of which Yale returned the principal pieces of the artifacts in time for the commemoration of the 100th anniversary of the scientific discovery of Machu Picchu.

Over the years, these developments resulted in a global team in 2016 of 175 international arbitration practitioners.

Paul Friedland, head of the Firm’s international arbitration practice, notes: “Our international arbitration practice fits naturally into the Firm’s global strategy and has benefited from its global platform. We believe we have earned the high regard in which our practice is held but know we cannot be complacent because there are competitors and the market continually evolves. We are keen to see where the opportunities will arise in the future, knowing that we are well positioned to make the most of them.”

The Firm’s antitrust practice dates from the 1930s, spurred by the increased enforcement of antitrust legislation by the Roosevelt Administration. Lowell Wadmond represented the Firm’s client, Swift & Company, in its defense against federal antitrust charges by a competitor, Hansen Packing Company. But it was not until the 1960s that the Firm’s reputation for antitrust work gained traction. This arose from the Firm’s representation of General Electric Company (GE) in the so-called “electrical antitrust case.” The antitrust division of the U.S. Department of Justice (DOJ) alleged that GE, 28 other companies and 46 individual defendants had conspired to fix prices on major parts for electrical power plants.

Fortune

called it the “biggest criminal case in the history of the Sherman Act,” the 1890 legislation that created the antitrust law.

The White & Case team representing GE was led by Edgar Barton, then head of the Firm’s antitrust practice. The criminal charges were resolved in 1961 through plea negotiations under which the companies and some of the individual defendants pleaded guilty to some counts and nolo contendere

(a plea of no contest) to others. Several GE officers were each sentenced to 30-day jail terms, an unusual outcome by then prevailing standards when antitrust matters rarely, if ever, resulted in jail sentences.

The criminal case was followed by numerous civil actions brought against GE by customers seeking treble damages. White & Case was retained by GE to handle the actions brought in New York and to oversee and coordinate the defense of similar suits against it elsewhere in the United States. This massive effort continued throughout the 1960s, with most of the cases eventually being settled out of court. The Firm’s antitrust team was also heavily involved in defending U.S. Steel in a series of monopolization and price-fixing antitrust cases from the 1930s into the 1970s.

By the early 1970s, the Firm’s litigation lawyers were handling many antitrust cases, including defending clients in several treble damage class actions brought by those claiming to have suffered as a result of alleged price fixing. “Price fixing was a widespread practice in many markets during the 1970s,” remembers Rick Holwell, who joined the Firm in 1971. “Coming out of the ’60s decade, I was not enamored of Wall Street corporate America and was only intending to stay with White & Case for a couple of years before moving back into public work as a prosecutor. But the cases we were handling were so interesting, and so important for our clients, that I became enthralled. I ended up staying with the Firm for 32 years.”

The antitrust practice went through a lull in the 1980s following the retirement of two of the Firm’s senior antitrust partners, Ed Wolfe and Don Flinn, due in part to a less interventionist governmental policy. By the mid-1990s, the Firm had only one lawyer working full-time on antitrust matters. As far as Jim Hurlock was concerned, this was a gap that needed to be filled. The introduction by more countries of antitrust regulations, together with the globalization of business, required the Firm to have an international antitrust capability. The gap was filled with the lateral hire of antitrust lawyers Bob Paul and Mark Gidley in 1995, who had served in the U.S. Federal Trade Commission (FTC) and the antitrust division of the DOJ, respectively. As with so many others who have joined the Firm, Gidley was impressed with White & Case’s international platform and Hurlock’s global vision: “Hurlock intuitively felt that antitrust was going global, which is exactly what happened.”

Under the leadership of Paul and Gidley, the Firm built a strong antitrust practice both inside and outside the United States. One of the primary contributing factors to this growth was the willingness and ability of the Firm’s antitrust team to litigate cases involving novel issues and complex factual circumstances, including cases against the DOJ and FTC. One of these cases was arguably the most important U.S. criminal antitrust case of the past 30 years. In 1993, the DOJ introduced an amnesty program for companies, enabling them to escape prosecution for breaches of antitrust laws provided they came clean about their activities. The Norwegian transportation company Stolt-Nielsen, on the advice of its lawyers at the time, signed a contract in 2003 with the DOJ to enter into the “corporate leniency program.” The contract provided that neither the company nor its employees would be prosecuted following Stolt-Nielsen’s entry into the program and its cooperation in providing information concerning collaboration with competitors to fix prices. However, several months later, the DOJ said it would not honor the contract and intended to bring a prosecution.

Stolt-Nielsen then retained White & Case to represent it against the DOJ. The Firm took the unprecedented step of suing the DOJ for breach of contract, something that had never been done before by a private company. This was considered to be a highly risky move, but one that paid off. The White & Case team, led by Gidley and Chris Curran, first won an injunction against criminal prosecution by the antitrust division of the DOJ in January 2005—also the first time that had ever happened—and though the injunction was ultimately set aside on appeal, it provided breathing space for Stolt-Nielsen to recover from its financial difficulties and for the White & Case team to assemble evidence undermining the veracity of the DOJ witnesses. In preparation for the trial, the Firm conducted over 2,000 witness interviews in 24 countries. On November 30, 2007, after a three-week criminal trial, the federal district court in Philadelphia ruled that Stolt-Nielsen’s amnesty agreement should be upheld, held that the DOJ had not followed due process and dismissed the indictment. This was the first time that an amnesty agreement had been upheld in a court and the first time anywhere in the world that a court enforced an antitrust amnesty promise against an antitrust agency—and there are more than 50 countries with antitrust amnesty programs modeled after the U.S. program.

Gidley’s verdict is that Stolt-Nielsen “was probably the biggest victory in the history of our practice and set an international precedent for due process in government antitrust cases.” The favorable outcome was also of critical importance to Stolt-Nielsen because, apart from the criminal fines and imprisonment the company and its officers faced, the win helped Stolt-Nielsen defeat parallel government probes in Europe and elsewhere. Private cases were defeated in a major 2010 U.S. Supreme Court case.

Over the years, the Firm’s antitrust team became known as one that could try class-action and individual-claimant cases involving price fixing and any other antitrust issue, and obtain merger clearances from the DOJ and FTC, in almost any industry. In one of these cases, a team of the Firm’s lawyers led by Chris Curran successfully defended Toshiba Corporation in a high-profile jury trial concerning alleged price fixing in respect of liquid-crystal displays, the flat panel displays found in televisions, phones, laptops and computer monitors. The six-week trial, which began in May 2012, was a class action against Toshiba, with all other defendants having settled before trial. The jury, after deliberating for less than a day, found in favor of Toshiba in a verdict producing no awardable damages. The strategy of the Firm’s antitrust team for Toshiba to go to trial as “the last man standing” was a bold one to adopt—but very successful in this case—because of the perception by many that a defendant should not risk a trial if most of the other defendants have settled.

Antitrust

The expansion of the Firm’s antitrust practice outside the United States was given a significant boost in 1998 by the merger with the Brussels firm Forrester Norall & Sutton.

“The Stolt-Nielsen case, combined with the growth of our practice in Washington and our merger in Brussels with Forrester Norall & Sutton, gave our antitrust practice critical mass, from which we have not looked back.”

Mark Gidley

On the merger clearance front, during the downsizing of the U.S. military in the late 1990s, the Firm represented Raytheon in its acquisition of Hughes Electronics, which combined two defense contractors specializing in missiles and “star wars” defense. The Firm has also obtained clearances for many transnational mergers, including in the past 20 years the U.S. clearances for all of Dutch company Ahold’s acquisitions of U.S. supermarket chains, such as Stop & Shop and Giant Food. The Firm assisted Mexican bread conglomerate Grupo Bimbo in transactions that increased the company’s presence in the United States, including its acquisitions of Sara Lee and Weston’s. The Firm represented Ireland-based Warner Chilcott in obtaining FTC and non-U.S. clearances for its October 2013 acquisition by Swiss-based Actavis in a stock-for-stock deal valued at about $8.5 billion, creating the third-largest U.S. and global pharmaceutical company. The Firm’s Washington, D.C. office worked on the FTC clearance, and evidencing the globalization of the Firm’s antitrust practice, members of the antitrust team in Brussels, Germany and Paris worked on clearances from European national authorities. The Actavis acquisition of Warner Chilcott also reflected the Firm’s growing specialty in pharmaceutical antitrust—particularly in New York, Brussels and Washington—representing more than 20 different pharmaceutical companies, including Pfizer and Novartis, in the defense of class actions and FTC and European Commission (EC) investigations. As of 2016, the Firm was defending antitrust claims totaling more than $100 billion and involving 14 brand drugs.

The expansion of the Firm’s antitrust practice outside the United States was given a significant boost in 1998 by the merger with the Brussels firm Forrester Norall & Sutton. The original suggestion of an approach to this Brussels firm had come from the Firm’s international trade practice, but it was soon realized that the merger would also help forge a stronger global antitrust practice by combining resources in Brussels, London and Washington. Ian Forrester was initially resistant to the approach by White & Case. The turning point came when Hurlock told him, “We don’t want you to come to White & Case, we want White & Case to come to

you

.” In other words, the practice in Brussels would continue to operate as it had always done—after all, it had acquired a leading reputation as a boutique practice over 20 years—but would benefit from White & Case’s strength and resources.

That is exactly what transpired. Forrester Norall & Sutton got the benefit of the worldwide White & Case platform and acquired credibility to handle the biggest controversies. After the merger, White & Case represented Microsoft in its epic antitrust battle with the EC for about 10 years, and Forrester had the curious experience of having argued the leading case on compulsory licensing, Magill

, on behalf of the EC, and then appearing against the EC in the Microsoft

case, in which the Magill

reasoning was crucial.

In other cases, the Brussels office has represented companies such as GSK, Pfizer (in cases about parallel trade and the precautionary principle), Toshiba, Toyota and many Central and Eastern European interests. Exemplifying its global expansion, the Firm’s Tokyo office successfully defended a high-profile case brought by the Japanese Fair Trade Commission against Toys “R” Us relating to the size of toy vendor discounts.

By 2016, the team of lawyers at the Firm required to handle the ever-increasing workload of the Firm’s antitrust practice had grown from one in New York in the mid-1990s to more than 180 worldwide.

Gidley, head of the Firm’s global antitrust practice, observes: “The Stolt-Nielsen case, combined with the growth of our practice in Washington and New York and our merger in Brussels with Forrester Norall & Sutton, gave our antitrust practice critical mass, from which we have not looked back. A hallmark of the practice has been strong teams created across offices throughout the Firm, willing boldly to go to court against the government and private sector claimants. Our practice is underpinned by our philosophy that nothing is impossible, and we are unrelenting in our dedication to our clients.”

The Firm’s asset finance practice began to grow in the 1970s out of the Firm’s historical relationship with Bankers Trust and was initially focused on tax-incentivized leasing of domestic U.S. assets, including in the power and energy, oil and gas, aviation, shipping, rail and other industrial sectors. The ability to transfer the tax benefits of ownership to a party better able to utilize these benefits was at the heart of the transactions in this area and had been a recognized tool of U.S. economic and tax policy since the 1950s. The “leveraged leasing” structure, as it came to be known, became a significant financing tool for many businesses, and billions of dollars of assets were financed in capital-intensive industries in the United States using this capital-raising method.

By the 1980s, the Firm had expanded its U.S. client base in this area to include insurance companies, banks and other financial institutions as well as industry-focused end users of the assets. Among these clients were Babcock & Brown, Citibank, Newmont Mining and Prudential Insurance Company. At the same time, the Firm’s asset finance practice was beginning to take hold in Asia and Europe, in particular for aviation and other transportation assets. The domestic U.S. practice remained strong across a range of asset classes under Cas Patrick and others in New York, but the international practice was fast becoming strong in its own right.

The Firm’s focus on growing internationally took another step forward at the beginning of the 1990s as the so-called “FSC” (Foreign Sales Corporation) form of lease financing took hold, primarily in the aviation sector. This technique was used as a form of export subsidy for the domestic U.S. aviation manufacturing industry, and Marianne Rosenberg and Jim Hayden were at the forefront of developing the structures that resulted in the leasing of U.S.-produced aviation assets to international air carriers.

The next significant step in the international scope of the Firm’s asset finance practice took place in 1994 when Larry Gannon and Chris Frampton led the Firm’s team that represented a Dutch utility, EPZ, in the lease financing of one of its largest coal-burning electrical generating facilities. This transaction was notable in two important respects. It was the first time a fixed asset of significant size and value was made subject to the U.S.-based leveraged lease structure, and it heralded a significant increase in the export of U.S. equity capital for investment in non-U.S. assets using this capital-raising method. A variety of U.S. institutions participated in the growth of this financing technique, including the investment divisions of U.S. utilities Potomac Capital, NYNEX and Southern California Edison, as well as traditional leasing investors Bank of America, Bank of Boston and Citibank.

At the height of this market, an estimated $20 to $30 billion worth of transactions were being completed each year in what became known as “U.S. cross-border tax leasing.” This financing technique was extended to a significant number of end users in Europe and Asia across a range of asset classes from rail, high-technology equipment and general public utility assets to the power generating facilities first financed in the EPZ transaction. Eventually, tax and accounting changes in the United States led to the demise of this market between 2003 and 2004.

During the growth years of U.S. cross-border tax leasing, the Firm was able to build relationships with various clients that served its broader objective of expanding its global reach. The Firm’s relationship with Verbund is a case in point. Originally retained in New York to provide representation for the cross-border tax lease financing of Verbund’s hydroelectric generating assets in Austria, the Firm was able to expand the relationship after those transactions were concluded, with the Firm’s lawyers providing advice from Paris on independent power investments in France, from Brussels on various anticompetition issues that Verbund was facing in Europe, and from London and Istanbul on various energy-related investments in Turkey. “The Verbund relationship was a perfect case study of the benefits provided by our international platform,” notes global practice head Chris Frampton, who represented Verbund in the original U.S. cross-border tax lease financings. “We were able to obtain a client on the basis of our product expertise in the New York office and, having gained the client’s confidence on that representation, to offer services that could be provided by other offices in different practice disciplines.”

After the demise of the U.S. cross-border tax leasing market, the Firm’s asset finance practice moved in a different direction. Having already made significant additions to its London and Paris offices in the late 1990s and early 2000s, the Firm continued to grow what became a strong export credit agency (ECA) and lender practice with a number of European ECAs and financial institutions, with a focus on the aviation sector. That was mirrored by the development of equally strong ECA-supported practices in Latin America (BNDES) and the United States (U.S. Ex-Im Bank). This industry-specific expertise was bolstered by the Firm’s work that began in the late 1990s for a growing number of aviation operating lessors, in particular by lawyers like Rick Smith and Tom McDonald with BBAM and International Lease Finance Corporation. Unlike tax-incentivized leasing, the operating lessor business was not driven by opportunistic investing in transactions where the tax benefits were priced into the financing, but rather by institutions that took a long-term view on the economic viability of owning assets in a sector (aviation) with multiple end users (airlines) operating in a global market.

Asset finance

“The Firm’s ability to adapt to changing legal and market developments will enable us to remain at the forefront of the global asset finance business.”

Chris Frampton

The financial crisis that began in 2008 caused significant disruptions in the flow of capital to companies in industrial sectors with significant capital expenditure requirements. In response, structured financing techniques began to be applied as an alternative to standard bank finance and tax-incentivized leasing to address financing needs. The Firm represented investment banks, underwriters, bank lenders, insurance and pension companies, other fixed income investors, private equity and hedge funds, ECAs and other sector participants in this evolution as structured financing solutions developed in one industrial sector were effectively adopted for other asset classes, and new funding sources became available to a wide variety of sectors. An example of this has been evident in the maritime sector, which experienced a prolonged downturn in the wake of the financial crisis. Among other consequences, the downturn caused owners and operating companies to seek alternative forms of capital as traditional bank lenders began to withdraw from the maritime sector and a wave of financial restructurings began to take hold across the sector. These developments led to seismic changes in the maritime industry. As private equity and hedge funds invested in the sector at unprecedented levels (including through the purchase of distressed debt and also through joint venture investing) and the ECAs were called upon to provide increasing levels of support to ensure the financing of the vessels being produced in the relevant domestic shipyards, a series of consolidations (through formal mergers and global alliances) began in what had historically been a very fragmented industry, and structured financing techniques were applied to develop a debt capital markets solution for the sector. The Firm’s asset finance team was at the center of these developments as the Firm became increasingly focused on the maritime sector. This included representing United Arab Shipping Company in its inaugural U.S. capital markets transaction in 2015 in which it successfully raised debt capital in a U.S. private placement/Regulation S transaction modeled on financing technology that had for many years been utilized by the aviation sector.

Global practice head Chris Frampton observes: “We responded to the downturn in the maritime sector and the other financial disruptions resulting from the 2008 financial crisis as promptly and effectively as we did to the earlier demise of the U.S. cross-border tax lease financings. The financing techniques and solutions for capital expenditure-intensive sectors will continue to evolve, and we believe the Firm’s ability to adapt to changing legal and market developments, as demonstrated so many times in the past, will enable us to remain at the forefront of the global asset finance business.”

As the decade of the 1980s began, fewer than 10 of the Firm’s 65 partners considered themselves bank finance practitioners, and only a few of those who did practiced exclusively bank finance. All this would change dramatically as the bank finance practice evolved and grew over the next 30 years to reflect the transformation of White & Case into a major global law firm.

Bankers Trust, as it had been from the Firm’s earliest days, was the practice’s principal client in 1980, but the Firm also represented a number of non-U.S. banks, including Deutsche Bank, Banque Nationale de Paris and Swiss Bank Corporation.

Through the 1980s, the Firm advised Bankers Trust on a succession of “first” transactions. In 1980, White & Case advised on five of the six transactions that Bankers Trust New York Corporation (BTNY) featured in its annual report as having made 1980 a successful year for BTNY, including a $750 million credit facility to Ente Nazionale per L’Energia Elettrica, Italy’s state-owned power company, at the time the largest prime rate-based credit arrangement ever made for a non-U.S. borrower. In 1981, a banking team acted for Bankers Trust and a group of more than 50 banks in syndicating $6 billion of credit facilities for Gulf Oil, a deal that was accomplished in just seven and a half days. In 1982, the Firm represented Bankers Trust in one of the largest hospital financings ever accomplished as of that time. In 1983, the Firm helped Bankers Trust complete the syndication of a $100 million commercial paper facility for Istituto Mobiliare Italiano, at the time the largest facility of its kind for an Italian private company.

Against that background, Memorial Day weekend 1984 was an important one for White & Case. It was over that weekend that the Firm gave up its 14 Wall Street and 280 Park Avenue offices (with 14 Wall Street and 280 Park Avenue being Bankers Trust’s primary New York offices) and on June 1 opened its new offices at 1155 Avenue of the Americas at 6th Avenue and 44th Street, a newly constructed 41-story black granite building. The move attracted the attention of both the real estate and legal service sectors because no major law firm was located so far north and so far west in midtown Manhattan.

Banking

“The KKR acquisition of RJR Nabisco is generally regarded to be the most famous leveraged buyout of all time, and at the time it was the largest and there had never been one of such size, scope and complexity.”

Sean Geary

The move also generated some internal controversy. Some partners felt the departure from the two Bankers Trust buildings might weaken the longstanding bond between the Firm and Bankers Trust to the Firm’s disadvantage. Others, including Jim Hurlock, believed the captive-client model was breaking down and that other banks would be more inclined to work with White & Case if it were less visibly associated with Bankers Trust. The proponents were ultimately proven to be right.

The move was well timed. Bank finance was transforming and diversifying, and the demand for top-quality legal services was growing. The source of the excitement was a surge of company acquisitions financed by high levels of debt: leveraged buyouts (LBOs). White & Case lawyers were at the center of this market, especially since Bankers Trust was one of the primary banks involved. Joe Halliday was the partner who led the White & Case team on the first big leveraged finance deal, Blue Bell, in 1984. Assisting Halliday was Eric Berg, then a third-year associate who would ultimately develop a large leveraged finance practice and become head of the global bank finance practice.

To the surprise of his partners, Halliday left White & Case to join a rival, Skadden Arps, the following year, but the Firm fortunately had a young partner, Sean Geary, who was ready to lead the bank finance practice forward. Geary worked with a team, including future bank finance partners Berg, Dave Joyce and David Koschik, to build one of the best-recognized leveraged finance teams in New York. Geary himself went on to become one of the legends among leveraged finance lawyers, in part because of his leading role in what is generally regarded to be the most famous leveraged buyout of all time. It was Geary who led the White & Case team advising the banks that provided the senior secured bank financing to private equity house Kohlberg Kravis Roberts (KKR) for its acquisition of RJR Nabisco for $24.5 billion. One of the banks was Bankers Trust, which, together with Manufacturers Hanover (known as Manny Hanny), Chase Manhattan Bank and Citibank, agreed to lend about $15 billion. A further $5 billion of subordinated debt (then known as junk bonds) was provided by a consortium led by Drexel Burnham Lambert.

VIEW IN GALLERY

Barbarians at the gate: the fall of rjr nabisco

by Bryan Burrough and John YelyarThe book about the celebrated leveraged buyout of RJR Nabisco.

With so many parties, the negotiations were difficult and complex. As Geary recalls, “We had to negotiate between the banks and KKR, between the banks themselves and between the banks and the junk bond issuers, all of which negotiations were hugely difficult because there was no market standard. Basically, all the major intercreditor issues were open to debate and, of course, there never had been a leveraged transaction of such scope, size and complexity when addressing credit issues.” He himself found innovative and inspired ways to help move negotiations forward. First, he got the four banks to agree on a “three-out-of-four” principle, to overcome the obstacle of one party holding things up. The second innovation was even more imaginative. The negotiators found themselves having to negotiate “final” intercreditor terms on Sunday, January 22, 1989, the date of the Super Bowl. Geary arranged for a television to be bought and installed in the offices of Shearman & Sterling, where the negotiations were being held. That enabled the lawyers, the bankers and everyone else to keep an eye on the football game, which was won in the closing seconds by the San Francisco 49ers after a much-celebrated pass by Joe Montana. One of the sticking points in the negotiations was over the issue of suspension of remedies, with one of the lead bank negotiators refusing to acquiesce to the consensus agreement of the other bank negotiators (and with the other three lead banks unwilling to force the issue). Geary then announced to the assembled company that there would be a lottery; whoever won would win the television. By a twist of fate, the lottery was won by the holdout negotiator. “She was so happy that she had won the television, she no longer cared about suspension of remedies. The deal was done!” recalls Geary, laughing at the memory.

The RJR Nabisco buyout was the subject of the 1990 book

Barbarians at the Gate

, authored by investigative journalists Bryan Burrough and John Helyar. As the largest LBO ever (at the time and for many years thereafter), the RJR Nabisco transaction cemented White & Case’s reputation as a leading leveraged finance firm. Many more mandates from Bankers Trust, Manny Hanny, Chase Manhattan Bank and Chemical Bank followed, including the financing of the merger between Time and Warner Brothers in which the Firm acted for Manny Hanny. During this period, it seemed that almost every week a new major deal or two would be announced, and White & Case was involved in probably eight out of 10 of them, Geary recollects.

Things were ostensibly moving in the Firm’s favor. More banks entered the market as they saw the opportunities arising from being lead agents and arrangers on leveraged finance transactions, and the market itself was growing fast. On the other hand, a number of developments worked against the expansion of the Firm’s multiclient LBO practice. As the leveraged finance business grew in size and profitability, the banks engaged in this business became increasingly competitive and more “proprietary” about their product. For some banks, the Firm’s historical association with Bankers Trust continued to be a concern, and they began to look to diversify their base of lawyers beyond White & Case. In addition, a number of major financial institutions in the industry embarked on a series of mergers and acquisitions. In 1991, Chemical Bank merged with Manny Hanny, and that was followed in 1996 by a merger of Chemical Bank with Chase Manhattan Bank and by a merger in 2000 with J.P. Morgan & Co. In the wake of these acquisitions, White & Case lost out at times to some of the firms with more entrenched relationships with the surviving entity.

Another event that might have posed difficulties for the White & Case banking practice was the acquisition in 1999 of Bankers Trust by Deutsche Bank, the first and at the time the largest acquisition of a U.S. money center bank by a non-U.S. bank. Kevin Barnard led the White & Case team that acted as regulatory counsel for Deutsche Bank. Fortunately, both Bankers Trust and Deutsche Bank were long-term clients of the Firm, and the acquisition did not result in a diminution of business for White & Case.

As the 1990s progressed, the convergence of investment and commercial banking, driven in part by changes in the Glass-Steagall Act, led large commercial banks such as Bankers Trust and Chase Manhattan to acquire or build out securities operations akin to those of the traditional investment banks and, in turn, for traditional investment banks to develop lending capabilities. As these developments unfolded, commercial banks and investment banks began to hire laterally from each other, resulting in increased competition, but, more importantly for White & Case, also presenting the opportunity to follow bankers from one financial institution to another and expand the Firm’s client base. The convergence also made it important for the Firm’s banking practice to be able to offer clients top-flight capabilities in the high yield debt securities area. To that end, a number of lateral hires were made, including Gary Kashar and Ron Brody and his team in New York, and Rob Mathews in London. Brody introduced global investment bank Jefferies to White & Case and together with David Bilkis, who stepped in to develop bank finance work with Jefferies, helped make Jefferies a major client.

As leveraged finance continued to grow significantly both in volume and value, so did White & Case’s bank finance practice. In 1990, the market volume was $17 billion with just 40 issuances. Ten years later, the market had grown to $370 billion with more than 1,600 issuances. By 2012, after a post-Lehman crisis drop-off in new issues, the annual volume reached $760 billion with more than 2,200 transactions. To respond to this growth in the U.S. market, the Firm made a number of leveraged finance partners in New York in the 1990s and 2000s, among them Bilkis, Joe Brazil and Eric Leicht, the current head of the Firm’s banking practice in the Americas.

The late 1990s also saw a significant expansion of leveraged finance activity by the Firm’s clients in Europe. White & Case already had a preeminent bank finance team in Paris led by Gilles Peigney (and Raphaël Richard, following Peigney’s retirement in 2012) that handled this increased activity for banks in Paris, including the major French banks. In 2000, to deal with increasing activity in London, White & Case recruited Maurice Allen and his team in London and asked Mike Goetz, a partner in New York, to join them. Allen and Goetz built a strong team in London and worked with the global bank finance team to build out other locations in Europe, including Frankfurt and Hamburg. In short order, White & Case became one of the few global firms with top-tier bank finance practices in both New York and London. The Firm developed policies of partner and associate secondments between the two offices and between other offices in the Firm’s network, so that they would operate as an integrated group rather than as separate practices in different locations. While Allen and Goetz later moved on to other firms, White & Case’s bank finance team in London continued to grow and is currently led by Lee Cullinane, who joined the Firm in 2010. In addition to France and Germany, the bank finance practice also continued its growth in continental Europe, including Finland, the Czech Republic, Italy, Poland, Sweden, Russia and Turkey. Meanwhile, in 2008 John Hartley was hired laterally in Hong Kong with a mandate to build and lead White & Case’s leveraged finance practice in Asia. The practice grew dramatically to offer bank finance and high yield capability in Beijing, Hong Kong, Singapore and Tokyo.

The strength of the Firm’s bank finance practice is demonstrated in part by how well it performed after 1980 during periods of dislocation and interruption in the growth cycle, including: Black Monday in October 1987; a mini-crash in October 1989; the “dot-com bubble” crash in March 2000; and the financial crisis of 2008–2009. Out of adversity came opportunity. In each of these downturns, the banking practice advised its clients on the effects of the market dislocations and their credit and regulatory implications and received mandates in the restructuring and workout areas, offsetting to a significant degree the impact of the decline in new financing activity. For example, as a result of the many leveraged finance transactions the Firm had worked on in the years leading up to the financial crisis, White & Case found itself front and center for a number of the restructurings involving these credits. Examples include: advising Deutsche Bank on a $575 million multijurisdictional debtor in possession (DIP) financing for Aleris International; representing an ad hoc group of lenders to Six Flags in defeating the company’s proposed chapter 11 plan; and representing the Chrysler Non-TARP Lenders Group, holders of portions of the $7 billion secured debt issued by Chrysler, in the restructuring and proposed sale of Chrysler to Fiat, the UAW and the U.S. government.

The advantages of the global nature of the Firm’s bank finance practice became evident in the years following the financial crisis. While European markets continued to be affected by macroeconomic uncertainty and struggled to recover, and emerging market economies, particularly China’s, began to slow, the depth and liquidity of the U.S. loan market proved to be an attractive alternative for European and Asian borrowers. White & Case bank finance lawyers in London and New York advised on innovative financing deals that allowed European and Asian leveraged finance borrowers to access New York law-governed U.S. loans.

One of the first deals of this type was completed in January 2012, in which White & Case lawyers advised Deutsche Bank on a $2 billion senior secured credit facility provided to Colfax Corporation, a manufacturing and engineering company, to finance Colfax’s cross-border acquisition of Charter International. A series of similar, multijurisdictional transactions followed, with the Firm advising clients such as Deutsche Bank, Credit Suisse, Jefferies and JPMorgan Chase.

Also during this period, the Firm’s history of doing bank finance work in the shipping industry, a practice headed by Joyce, led to White & Case being involved in some of the most complex restructurings in the industry, including the General Maritime Corporation chapter 11 proceeding and restructuring, and the TORM out-of-court restructuring.

White & Case also continued to provide bank advisory services to its financial institution clients, and with the dramatic increase in finance legislation and regulation following the financial crisis (including the enactment of the Dodd-Frank Act in 2010 and similar legislation in the UK and other countries), the Firm’s global bank advisory team remained active in advising financial institution clients around the world. The practice, led from 2008 to 2015 by Duane Wall and Ernie Patrikis and thereafter by Kevin Petrasic, began in 2015 to expand its activities relating to the accelerating convergence of the financial and technology sectors, including marketplace lending, payment systems, mobile banking and other fintech products and services.

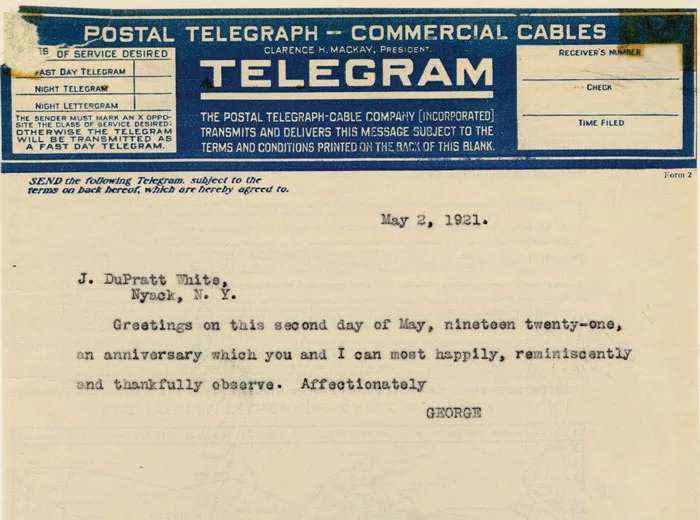

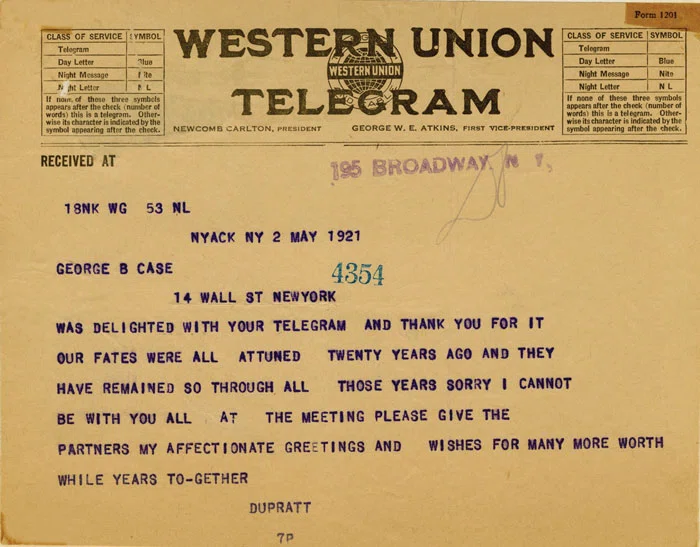

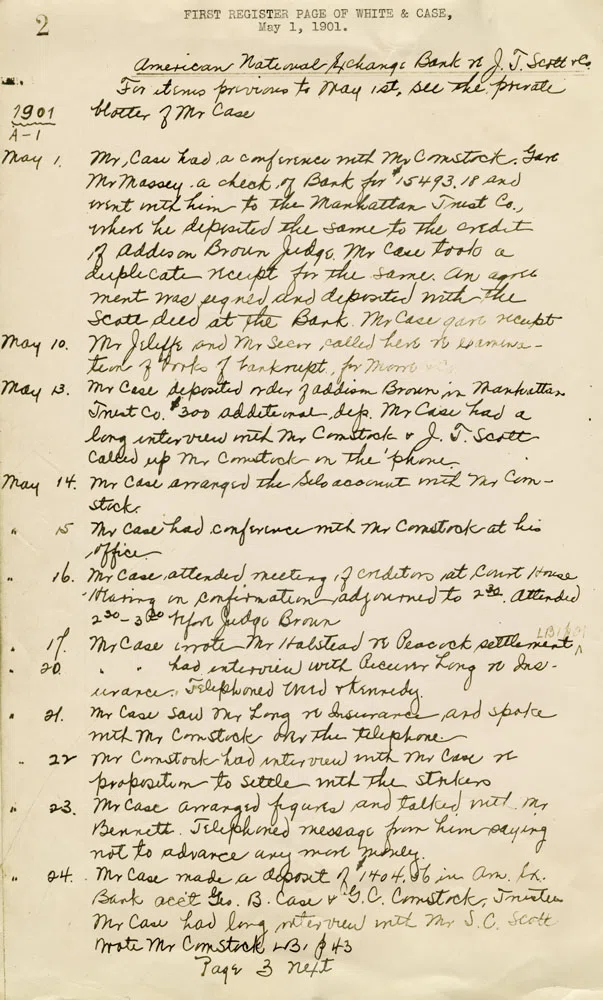

“There are now more lawyers in the Firm’s bank finance practice than there were lawyers at the Firm in 1980,” observes Berg. “We achieved this growth by becoming one of the few global law firms that can combine New York, English and local law expertise and experience to act for financial institution clients in complex cross-border financings in all of the world’s major financial markets.” With a look back to the Firm’s history, Berg reflects: “DuPratt White and George Case established our banking practice very early on by incorporating Bankers Trust in 1903, and those of us in the practice now are pleased and proud to carry the flame forward. Times and circumstances have changed since those early days, but our dedication to our banking clients has never faltered and never will.”

“We are one of the few global law firms that can combine New York, English and local law expertise and experience to act for financial institution clients in complex cross-border financings in all of the world’s major financial markets.”

Eric Berg

The advantages of the global nature of the Firm’s bank finance practice became evident in the years following the financial crisis of 2008—2009.

The growth of the Firm’s capital markets practice, including privatizations involving the public offering of securities of the enterprise being privatized, benefited from the globalization of the Firm. The capital markets practice expanded from concentrating on traditional corporate work in the 1980s to a practice that became diversified both geographically and in the range of products on which the Firm advised.

U.S. practice

The securities activity of the Firm’s capital markets practice in the United States consisted for many years of acting for issuers rather than underwriters. This was the result, to some degree, of the Glass-Steagall Act. Many of the Firm’s clients in the 1930s were commercial banks that were required by Glass-Steagall to exit and stay out of the investment banking business.

The Firm was fortunate, however, to represent its corporate clients as issuers on a regular basis and, in this capacity, to stay abreast of developments in the securities market and establish contacts with all major investment banks. Among these clients was GECC, a subsidiary of General Electric; for many years the Firm handled almost all of GECC’s U.S. public and international securities offerings.

One of the first areas in which the Firm expanded its securities activity in the United States beyond issuers was municipal finance. During the first half of the 1980s, municipal bond financing became very popular, in part because the Ninth and Tenth Amendments to the U.S. Constitution resulted in the income received on debt securities issued by state and local governments being exempt from federal taxation. White & Case became quite active in the municipal finance sector, in part because of its experience with The Municipal Assistance Corporation during the New York City financial crisis in the 1970s and its relationship with Bankers Trust, a major player in the municipal market during the relevant time period. The Firm represented clients involved in every conceivable role in the process, including issuers, underwriters, municipal authorities, purchasers, guarantors, users, bond insurers, letter of credit providers, tender agents and trustees.

By the beginning of the new century, the Firm had enhanced the capability and reputation of its securities practice in the United States to the point where it was representing underwriters in the U.S. financial markets on a regular basis. This improvement in the standing of the practice, together with the strength and reputation of the Firm’s global reach and resources, gave the Firm the credentials to be retained by Visa to handle its $17.9 billion initial public offering (IPO) in 2008, at that time the largest IPO in U.S. history. This was an unusually complex transaction, involving the prior reorganization of the company (which was owned by about 30 banks). Visa made concurrent public offerings in the United States, Canada and Japan in a transaction that involved 45 underwriters and 175 countries. The magnitude and cross-border complexity of this deal required a White & Case team of 75 lawyers in 25 offices.

The enhanced market recognition of the Firm’s U.S. securities practice and the Firm’s global capabilities were also key factors in enabling the Firm to become one of the leading firms in representing non-U.S. companies in their public capital-raising activities in the United States. In particular, partners Colin Diamond, Josh Kiernan and David Becker led the development of the Firm’s dominant practice in representing Israeli companies (including Caesarstone, CyberArk Software, SodaStream and Wix.com) in issuing securities in the United States in the technology and other sectors, and Don Baker and John Vetterli led the Firm’s development of one of the leading practices in representing Latin American companies in accessing the U.S. capital markets.

Most recently, the Firm has expanded its U.S. capital markets practice to include the representation of U.S. public companies, including Calpine, Dynegy, Ethan Allen and JetBlue, in a broad range of capital markets and corporate governance activities, in many cases accompanied by corporate and M&A work.

As Diamond has noted: “During the last 15 years, we have created a U.S. capital markets platform that has enabled us to expand significantly our client base of both U.S. and non-U.S. companies, and we have gained a reputation among issuers and investment banks for our ability to execute not only routine, but also large and complex, transactions at both the U.S. and international level.”

Capital markets

Global practice

White & Case commenced its capital markets practice in London even before the Firm opened its office there in 1971. That was during the early days of the development of the Eurodollar market, and in 1970, lawyers, including those who would later staff the Firm’s London office, represented Bankers Trust as fiscal agent in the issuance by Enel of what

The New York Times

reported were the first floating rate notes (FRNs) ever issued. According to the Times

, at $125 million, the Enel deal was also the largest public Eurodollar debt offering as of that time.

After the London office opened, lawyers there were regularly involved in FRN and Eurobond issuances for both issuers and underwriters. For example, in 1975, the office acted for the underwriters in an offering of FRNs by the South African Electricity Supply Commission and, in 1979, it acted for the Republic of Indonesia in a Kuwaiti dinar bond issuance.

During the mid-1970s, the London office also helped its banking clients develop a new product: the interest rate swap. These swaps were developed in part as a way to hedge the risks of interest rate movements. The lawyers in the office gave detailed advice on the bankruptcy and other legal aspects of these swaps, and also provided the staffing that some of the Firm’s banking clients required to deal with the almost overwhelming amount of paperwork generated by the huge number of swaps entered into by these clients. One of the Firm’s banking clients recruited two White & Case associates to take on this work, and they handled up to 70 deals simultaneously at the peak of activity. Eventually, the documentation for these swaps became standardized, but it was not that way in those early days of the market.

In the early 1980s, the London office continued to represent both issuers and underwriters. The lawyers in the office worked closely with GECC as one of the first frequent issuers in the Eurobond market, making several issuances a year until it established one of the earliest Euro medium-term note (MTN) programs and a Euro-commercial paper (ECP) program in 1990. In 1984, they represented the underwriters in the issuance by the World Bank of FRNs that were the first notes to be issued outside the United States bearing interest based upon a domestic U.S. interest rate, the three-month commercial paper benchmark rate.

The Firm’s sovereign practice is international by definition, and since 1975 the Firm has helped nearly 60 sovereign countries across a range of capital markets transactions and other matters. In 2012 and 2013, the Firm represented some 10 sovereign nations in $25 billion of financings in more than 20 separate transactions.

The Firm represented Indonesia in its first U.S.-registered offering of “Yankee Bonds” in 1996 and has been among the leaders of law firms that handle such offerings, including the U.S. shelf registrations of Italy, Poland and Thailand.

Between 2007 and 2015, 11 sub-Saharan African sovereign issuers came to the public capital markets for the first time: Angola, Côte d’Ivoire, Ethiopia, Gabon, Ghana, Kenya, Namibia, Nigeria, Rwanda, Senegal and Zambia. The Firm advised on nine of these transactions in this rapidly developing corner of the world.

In Latin America, the bulk of the Firm’s capital markets work was generated historically with the support of client relationships built out of the Firm’s Mexico City and São Paulo offices, but the growth of the Firm’s Spanish-speaking team over the past 15 years has enabled the Firm to develop significant capital markets work in Argentina, Chile, Colombia and Peru as well. Thomson Reuters has reported that during 2011–2016, the Firm advised on about $65 billion in debt and equity capital markets transactions out of Latin America, enhancing the Firm’s reputation of working on first-to-market and other notable transactions in the region.

Another significant development that played well into the Firm’s growing international capital markets practice was the change of legislation in the United States in 1990 that opened access to the U.S. capital markets to non-U.S. issuers. Rule 144A, an amendment to the Securities Act of 1933, enabled non-U.S. companies to raise money from U.S. institutional buyers without registering their securities with the U.S. Securities and Exchange Commission.